Pandemic Budgeting: Frugal vs Cheap

Do you want your nonprofit to emerge strong and healthy from the pandemic?

Understanding the difference between frugal and cheap will help you in any year, but it has increased urgency as you build your next budget.

A culture of cheapness

American culture, and our nonprofits, have deep roots in the Puritan and Calvinist doctrines that found joy sinful and self-denial the epitome of virtue.

400 years later, these zombie beliefs still afflict us as the “overhead myth”: that you can somehow measure the impact and overall worth of a nonprofit based on how little they spend on overhead.

In reality, the culture of cheapness does significant harm to nonprofits and the causes we support. Among other things, it encourages our nonprofit leaders to create budgets that are penny wise and pound foolish.

Frugality (so much smarter than only looking at the price tag)

Successful nonprofits choose frugality instead.

Instead of guiding their decisions by the price tag alone (cheapness), they take a more nuanced approach. They ask questions like:

How long will this product last me?

How efficient is this tool?

What’s the overall impact of using X versus Y?

In other words, they seek to maximize total value and impact (return on investment), not just minimize direct expenses.

Don’t just take my word for it

In 2010, the Harvard Business Review published a great study of how organizations fared in the 2008 recession. Ranjay Gulati, Nitin Nohria, and Franz Wohlgezogen found that organizations that responded to the recession with cheapness, like cutting costs across the board, had the most likelihood of closing their doors.

Which organizations had the best chances to survive and thrive? The organizations that combined strategic, thoughtful cuts with strategic investments (often in technology) had the best chances of emerging strong from the recession.

Stop me if you’ve heard this one ….

How often do you run into nonprofits where the staff all have access to top-notch technology? Good computers, the right software, integrated systems, responsive tech support, and the like? In my experience, they’re the exception.

Look closely at most non-profits and most of the time you’ll find:

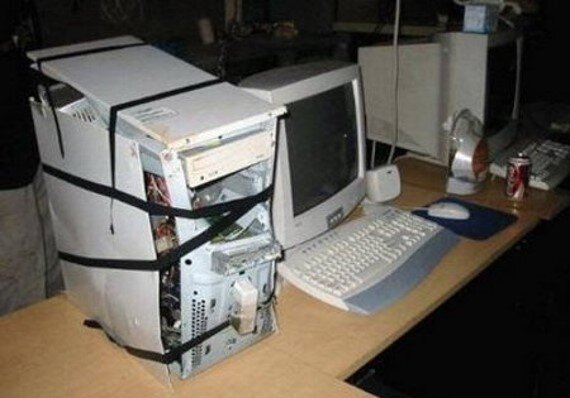

computers held together with duct tape and a prayer

only free, or super-cheap, software

everyone has to train themselves how to use the software (so most muddle along rather than ever mastering it)

a dozen different systems even when good integrated systems exist to provide the same functions

do-it-yourself tech support

Does this cheapness serve them and their cause well? It certainly does not!

How can we transition from cheapness to frugality?

I love helping nonprofits make this transition!

Once upon a time, I was working with a great nonprofit: smart, dedicated staff; a blue-ribbon board; lots of respect in the community; and they made a big difference for those they served.

Then I got a look at their computers. Everyone was using a laptop they’d received second hand from a grant maker that had decided they were too worn down and obsolete for their own staff. Many wouldn’t hold a charge while others needed constant tech support. All moved slowly and needed frequent rebooting. On top of that, this equipment created morale problems because of the message they sent about the value of staff’s time.

I pointed this all out to the executive director, who by all accounts was a smart, business-savvy person. My initial communication plan, “this is so obviously bad,” fell on deaf ears.

So I crunched the numbers to paint the picture. Using conservative estimates, I showed:

$1,500/year per employee in lost productivity

Good, new laptops might cost only $700 and can last 2-5 years

Once I helped connect the dots, the executive director eagerly made the transition from cheap to frugal. This in turn, boosted productivity, morale, and impact.

Lessons for your organization’s budget

Most organizations have multiple areas where they’ve chosen cheap over frugal. That represents a great opportunity! Can you help them identify those areas and demonstrate how spending a little more now will earn a good return on investment?

You might take a look at such areas as:

Staff compensation: low pay and benefits don’t help you attract or retain the most productive staff. For example, sometimes paying $30/hour to hire an outstanding candidate will get you more productivity than two mediocre candidates at $20/hour.

Low-tech solutions: many automated business processes have become affordable and sensible for even small nonprofits. Expense reports, credit card management, and paying bills can all become quick, painless, and not even particularly expensive.

Double entry of data: Are you entering the same data in multiple places? Manually? You can integrate many modern systems so they talk to each other and share data.

[Originally published in the Bloomerang blog.]